💸 Are you in control of your money or is money in control of you? 3 Tools for financial wellness at any stage in your journey. 🧗🏽

Often overlooked, financial wellness can have a profound impact on our mental, physical and emotional health. Whether it’s anxiety building over mounting credit card bills, fear of a pending recession or the concerning tariffs everyone’s talking about, I’ve always found, the best way to combat fear is with knowledge. I used the three tools below to change my financial future:

🤑When you feel secure in your financial future you can make choices that allow you to take risks and enjoy life in ways you may have never imagined. Like starting a business, investing in yourself, your education or simply traveling somewhere completely foreign to you, opening your eyes to new ways to see the world, yourself, and more.

👍Like/Share if you use these tools already or find them helpful. Disagree? DM me and let me know why, I’m always up for meaningful discussion.

✍When did you discover financial literacy? In what ways has it changed your life? Share your favorite books, resources or tools in the comments below.

Follow for more content on:

#Wellbeing #FinancialEducation #FinancialLiteracyMonth

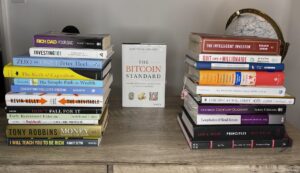

Disclaimer, I am not promoting or endorsing any of the books or authors shown in the photo above. This photo is a small sample of reads I found interesting and invaluable at different stages of my financial education and quest to understand monetary value, theory and economics.

Stay in the loop with the latest updates, exclusive offers, and engaging content! Subscribe for free and be part of our vibrant community. Join us on this exciting journey!